When you invest in US stocks, you have purposely chosen a lucrative venture, offering access to a vast and diverse market with countless opportunities. However, it requires careful planning and research to navigate the complexities and maximize returns. Understanding key factors, like tracking the Tesla share price, can help you make more informed decisions. In this article, we will explore effective strategies to maximize your returns in U.S. stock investments.

Understanding the U.S. Stock Market

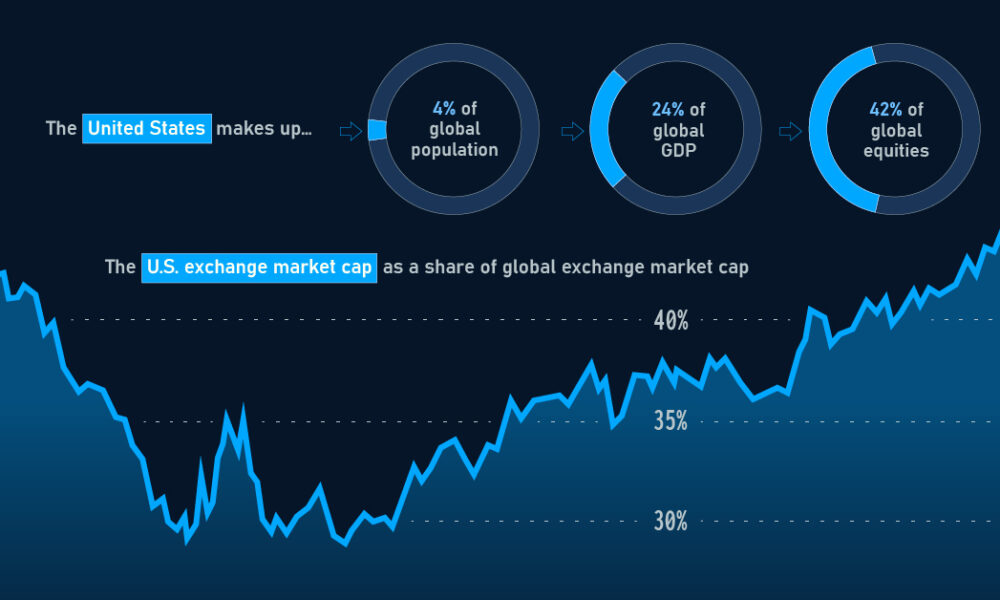

The U.S. stock market is one of the largest and most liquid in the world, including major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite. These indices cover a variety of sectors and company sizes, offering a range of investment opportunities for those who invest in US stocks. For instance, the Tesla share price has been a significant driver in the Nasdaq, reflecting the company’s rapid growth and market influence. Staying informed about these indices and individual stock movements is crucial for investors.

Research and Due Diligence

Before making any investment, it’s essential to conduct thorough research and due diligence. This involves analyzing the company’s financial health, its position within the industry, its competitive landscape, and future growth potential. For instance, if you are considering Tesla, reviewing the company’s revenue growth, profit margins, and the factors driving the Tesla share price will help you assess its viability as an investment. Remember, a stock’s historical performance is not always indicative of its future potential, so careful analysis is key when you invest in US stocks.

Diversification

Diversification is a core principle of successful investing, as it helps to spread risk across multiple assets. When you invest in US stocks, it’s important not to place all your capital in one stock or sector. For example, while the Tesla share price may be rising, it’s wise to balance your portfolio with stocks from different industries like healthcare, finance, and consumer goods. Diversifying your investments reduces the impact of any single stock’s performance on your overall portfolio, helping you manage risks more effectively.

Long-Term Perspective

When you invest in US stocks, it’s best to adopt a long-term perspective. U.S. stocks, particularly those like Tesla, can experience short-term volatility. The Tesla share price, for instance, may rise and fall based on news, quarterly earnings reports, or market sentiment. However, focusing on the long-term growth potential of companies can help you avoid impulsive decisions. Investing with patience allows you to weather short-term market fluctuations and benefit from steady, long-term growth.

Dollar-Cost Averaging

One proven strategy for managing volatility is dollar-cost averaging. This involves investing a fixed amount in a stock or fund at regular intervals, regardless of its price. For example, if you are consistently investing in Tesla, the Tesla share price may fluctuate, but this strategy helps average out the purchase price over time. This approach minimizes the risk of timing the market and ensures that you continue gradually building your position in a company, which can be advantageous in the long run.

Conclusion

By understanding the U.S. stock market, conducting thorough research, diversifying your portfolio, and adopting a long-term perspective, you can maximize your returns. Keeping an eye on key stocks like Tesla and the Tesla share price can provide valuable insights into market trends. As always, stay informed, adapt to market changes, and seek professional advice when necessary to enhance your investment journey.